Why I Chose to Invest in Etsy Stock

Current Price of Etsy Stock: What Attracts Me

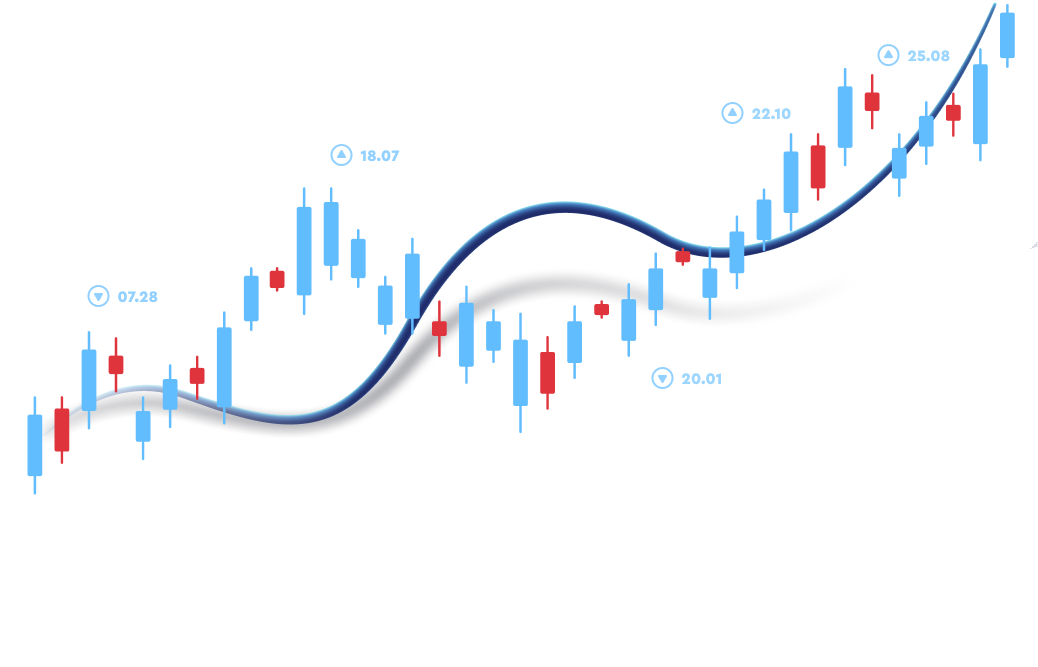

My Preferred Buying Zones for Etsy Stock

- First support at $72

- Second support at $56

- Third support at $42

- Fourth support at $29.24

- Fifth support at $11.77

- Sixth support at $2.05

- These support levels are strong buy targets for investors, likely resulting in heavy buying and a potential trend reversal from bearish to bullish.

- The company’s competitive strength and noticeable growth bolster the first factor, attracting investors when the stock is low, given the company's financial improvement.

2 Comments

Thank you So Much

ReplyDeleteYour Welcome Said, Best Regards

Delete