My Personal Experience with Etsy Stock: Current Buying Opportunities and Attractive Price Points

Why I Chose to Invest in Etsy Stock Etsy is a global leader in E-commerce, experiencing continuous growth over the past few years. It attracts an imp…

Stay updated with our newest articles and blog posts. Explore the latest trends, tips, and strategies in the world of investments, digital currencies, and stock markets. Gain valuable insights from our personal experiences and expert analysis to enhance your financial knowledge and investment success.

Why I Chose to Invest in Etsy Stock Etsy is a global leader in E-commerce, experiencing continuous growth over the past few years. It attracts an imp…

Investment Tips: Get practical tips for investing in stocks and cryptocurrencies.

Proven Strategies: Discover strategies that have proven successful in the author's investment journey.

Current Trends: Stay updated with the latest trends in the stock and cryptocurrency markets.

Market Analysis: Read thorough market analyses to make informed investment decisions.

Investment Calculators: Utilize calculators to plan your investments and forecast potential returns.

Resource Library: Access a library of resources, including e-books, videos, and training materials.

In the world of investing, this quote holds profound wisdom. Whether you're venturing into the stock market or exploring the dynamic realm of cryptocurrencies, the journey to substantial financial growth begins with the smallest of steps.

Successful Investments

Investment Plans

Currencies

Experiences

Explore cutting-edge strategies for investing in digital currencies and company stocks. Stay ahead with innovative approaches that maximize returns while minimizing risks. Embrace the future of investing by leveraging the latest trends and technologies in the financial markets.

In the fast-paced world of digital currencies and company stocks, it's crucial to make informed decisions rather than following trends without understanding them. Develop your own investment strategy based on thorough research and analysis to achieve sustainable success and avoid the pitfalls of blind imitation.

Enhance your investment portfolio by smartly diversifying across both digital currencies and company stocks. By spreading your investments, you can reduce risks and increase potential returns. Embrace a balanced approach to investing by including a mix of assets that align with your financial goals and risk tolerance.

In the world of stocks and digital currencies, making informed decisions is key to successful investing. Stay updated with the latest market trends, perform thorough research, and use reliable data to guide your investment choices. By being well-informed, you can navigate the complexities of the financial markets with confidence and precision.

Are you ready to achieve financial success and learn the secrets of investing in stocks and digital currencies? Join us on our blog journey where we share the latest tips, proven strategies, and comprehensive market analyses. Get inspired and learn how to make informed investment decisions to build a prosperous financial future. Don't miss out – start now and discover how you can become a successful investor!

Learn how to evaluate the intrinsic value of stocks and digital currencies based on economic and financial factors. This includes analyzing financial statements of companies, such as revenues and earnings, as well as keeping track of economic news and developments that may impact the market. Fundamental analysis helps you make informed investment decisions based on the underlying value of assets.

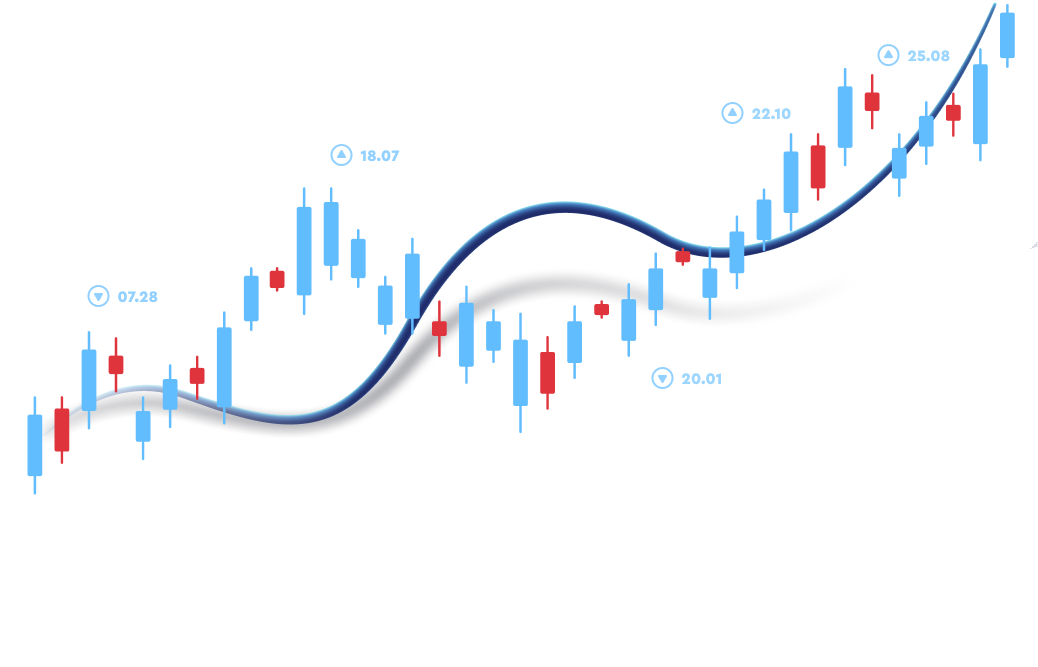

Learn how to read and analyze market charts to understand price patterns and trends. Technical analysis involves studying historical price movements and using technical indicators such as moving averages and the Relative Strength Index (RSI). This can help you identify optimal entry and exit points for investments and improve your trading strategies.

Learn how to manage risks to preserve capital and minimize potential losses. This includes developing strategies for determining the appropriate investment size and diversifying assets, as well as using stop-loss orders to protect investments. Effective risk management helps you achieve your financial goals while minimizing the risks associated with market volatility.

Answer: Stocks represent ownership in a company, offering shareholders voting rights and potential dividends. Cryptocurrencies, on the other hand, are digital assets that use cryptography for security and operate on decentralized networks, independent of traditional financial institutions.

Answer: Fundamental analysis helps investors evaluate the intrinsic value of an asset by analyzing factors such as a company's financial statements, management team, industry conditions, and economic outlook. It provides insights into whether a stock or cryptocurrency is undervalued or overvalued.

Answer: Technical analysis relies on indicators such as moving averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands. These indicators help traders identify trends, momentum, and potential entry or exit points for trades.

Answer: Diversification involves spreading investments across different assets, industries, or geographical regions. By diversifying, investors can reduce the impact of market volatility on their portfolio. A diversified portfolio is less likely to suffer significant losses from a single event affecting one asset class.

Answer: Risk management strategies include setting stop-loss orders to limit potential losses, diversifying investments to spread risk, using position sizing to control the amount invested in each asset, and staying informed about market trends and economic developments to make timely adjustments.

Discover essential tips and strategies to navigate the world of stocks and cryptocurrencies effectively. Learn how to conduct thorough research, diversify your portfolio, practice patience, set clear goals, stay informed, and implement robust risk management techniques. These proven tips are designed to help you maximize returns while minimizing risks in your investment journey.

Research is crucial before investing in any stock or cryptocurrency. Analyze financial statements, market trends, and news to make informed decisions. Understanding the fundamentals and potential risks helps mitigate losses and maximize returns.

Spread your investments across different stocks or cryptocurrencies to reduce risk. Diversification allows you to balance potential losses from one asset with gains from others, creating a more stable investment portfolio.

Investing in stocks and cryptocurrencies requires patience. Avoid reacting to short-term market fluctuations and focus on long-term growth potential. Patient investors often benefit from compounding returns and market recovery over time.

Define your investment goals, whether it's capital appreciation, income generation, or wealth preservation. Develop a clear investment strategy aligned with your goals, considering factors like risk tolerance and time horizon.

Stay updated with market news, regulatory changes, and technological advancements in cryptocurrencies. Adapt your investment strategy based on new information and market developments to capitalize on emerging opportunities and mitigate risks.

Protect your investments by implementing risk management techniques. Use stop-loss orders to limit potential losses, diversify your portfolio, and avoid investing more than you can afford to lose. Maintaining discipline and managing risks are crucial for long-term investment success.